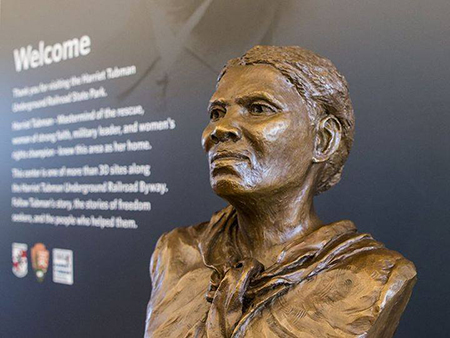

Heart of Chesapeake Country Heritage Area: Harriet Tubman Underground Railroad Visitor Center. Courtesy of Dorchester County Tourism.

Heart of Chesapeake Country Heritage Area: Harriet Tubman Underground Railroad Visitor Center. Courtesy of Dorchester County Tourism. Financial incentives for the Maryland Heritage Areas Program are awarded by the

Maryland Heritage Areas Authority (MHAA). To apply, an applicant must meet

both of the following criteria:

Non-profits in good standing with Maryland State Department of Assessments and Taxation, local jurisdictions, state and federal agencies

Projects that take place within the boundaries of a Certified Heritage Area, and are consistent with the goals, objectives, strategies, and actions outlined in the heritage area's planning documents.

Grants

Eligible Activities

MHAA provides dollar-for-dollar matching grants to

nonprofit organizations and

government entities for capital and non-capital projects located within a Heritage Area. Grants can support projects involving historical, cultural or natural resources, sites, events or facilities. Eligible projects must have a heritage tourism component or contribute to research that will directly inform a heritage tourism product. Full details are available in the

MHAA project grant guidelines.

Non-Capital. Grants of up to $50,000, with a required one-to-one match of non-state support, are available for non-capital projects, which can include

Planning (research, field investigation, data recovery, feasibility and planning studies, design documents and other planning activities that support the heritage area);

Interpretation (exhibits, signage, pedestrian wayfinding signage, interpretive brochures, educational programs and materials, other interpretive activities that support the heritage area); and

Programming (seminars, conferences, performances, reenactments, commemorations, festivals).

Capital. Grants of up to $100,000, with a required one-to-one match of non-state support, are available for capital projects, which can include

Acquisition (fee title of real property, interest other than fee title (i.e. easement) of real property);

Development (repair or alteration of an existing building, structure or site, new construction for heritage tourism purposes);

Rehabilitation (returning a property to a state of utility);

Restoration (accurately depicting a property as it appeared at a particular period of time, removal of features from another time period, reconstruction of missing features from the restoration period); and

Pre-Development (plans and specifications, fees for architectural design and engineering).

Information for Certified Heritage Areas about management, marketing, and block grants can be found

here.

Loans

Loans are available to

nonprofit organizations,

local jurisdictions,

individuals and

businesses to assist with the preservation of heritage tourism resources and the enhancement of heritage attractions and visitor services located within a Heritage Area. The maximum loan commitment made for any specific project is limited by available funds. Up to 50 percent of the total project cost will be provided based on an assessment of the applicant’s financial need. Refinancing will not be considered part of the project cost.

Eligible Activities

Acquisition (fee title of real property, interest other than fee title (i.e. easement) of real property);

Development (repair or alteration of an existing building, structure or site, new construction for heritage tourism purposes);

Rehabilitation (returning a property to a state of utility);

Restoration (accurately depicting a property as it appeared at a particular period of time, removal of features from another time period, reconstruction of missing features from the restoration period);

Leasehold improvements (rehabilitation, restoration, or minor new construction activities are eligible uses if the term of the lease is at least equal to the term of the loan); and

Purchase of equipment, furnishings, inventory.

Tax Credits

In addition to grants and loans, heritage tourism projects may also qualify for special tax credits. Within certified Heritage Area boundaries, a Maryland Historic Revitalization Tax Credit of up to 20% of the eligible costs of rehabilitation may be available for:

- historic structures that are eligible for, but not listed on the National Register of Historic Places; or

- non-historic structures that have been certified by the Maryland Heritage Areas Authority as contributing to the significance of the Certified Heritage Area; or

- properties that are listed individually or contributing to the National Register of Historic Places

These Maryland Heritage Area Program benefits are in addition to the more standard tax credits offered by the state for qualified rehabilitation work on qualified historic structures. For full details, please visit the

Maryland Historic Revitalization Tax Credit Program page.